Carbon Markets Infrastructure (CMI) Working Group

Paving the way for a more safe, efficient, and interoperable carbon market infrastructure

Key highlights and updates

Key highlights and updates

Ongoing review and feedback collection on latest draft documents:

Currently, the Working Group has drafted the following documents:

- Developed Preliminary Ecosystem Mapping (to be released soon).

- A Roadmap for Safe, Efficient and Interoperable Carbon Markets Infrastructure. It can be found here: [link].

For feedback, please contact climatewarehouse@worldbank.org.

Upcoming meetings and sessions:

9th Monthly Meeting: final review of five technical guidance notes.

What is the CMI WG?

What is the CMI WG?

Building robust and interoperable carbon market infrastructure is critical for ensuring market integrity and scalability. At COP28, the World Bank released an engagement roadmap towards rebuilding trustworthy and transparent carbon markets to have a tangible impact towards addressing the global climate crisis. This roadmap “High Integrity, High Impact: The World Bank Engagement Roadmap for Carbon Markets” recognized that the key enabler for this was reinstating trust in the carbon markets.

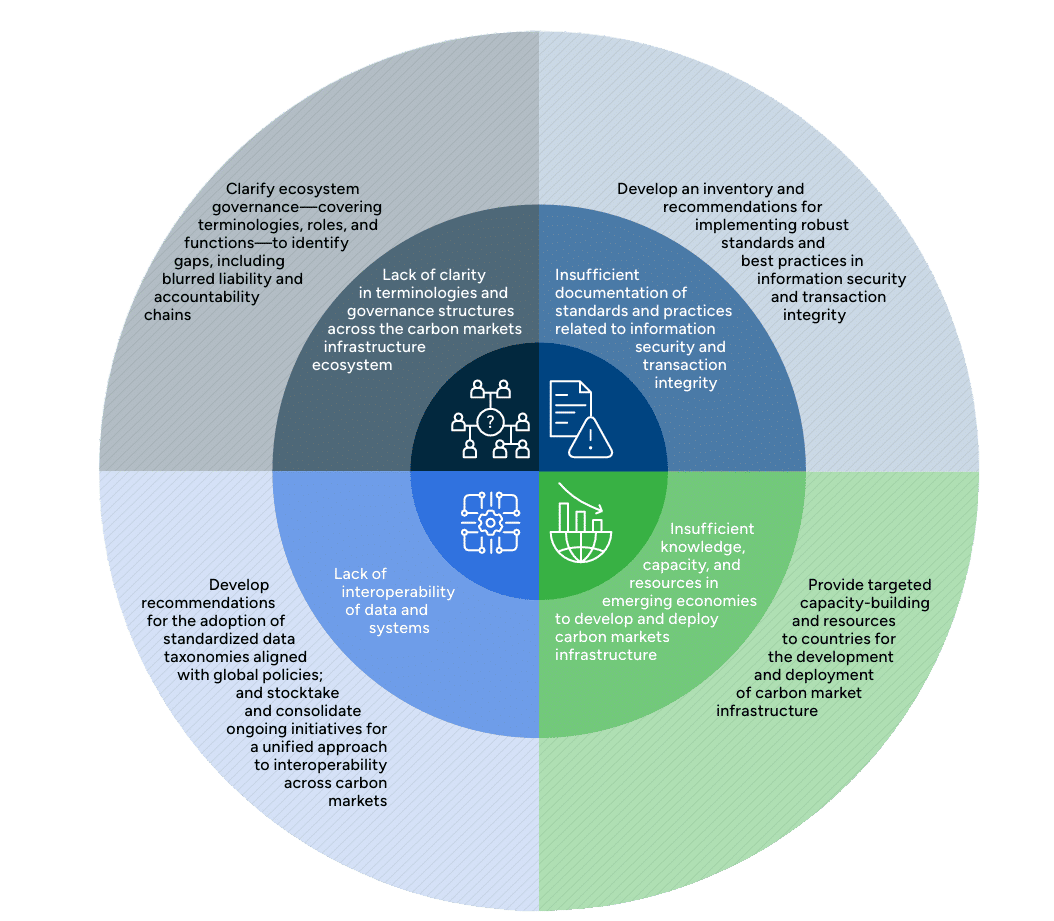

An integral part of reinstating and strengthening trust in carbon markets is through harmonizing and standardizing functionalities and entities across the carbon markets ecosystem. This would entail agreeing upon minimum service standards, common frameworks, and governance across the ecosystem of key players and entities such as principles-setters, independent standards, registries, validation and verification bodies, and rating agencies. This in turn requires entails working with all relevant stakeholders to unlock the most critical bottlenecks in global architecture and support development countries to build market infrastructure, institutions, and policy (see Figure 1 on key challenges and recommendations for carbon markets, in particular Figure 2, which illustrates challenges and potential solutions for carbon market infrastructure).

Key challenges and recommendations to strengthen carbon market infrastructure

In this context, the World Bank set up the Carbon Market Infrastructure (CMI) Working Group including a wide range of stakeholders ranging from policymakers, exchanges, regulators, standard setters, and other infrastructure providers across the value chain (see the current list of participants in the bottom of the page).

The objective of the Working Group is to identify key bottlenecks that hinder the security, efficiency, and interoperability of carbon market infrastructure, as well as outlining priority areas for action to address these challenges in the medium and long term. This collaborative effort is essential for building a robust system that supports global carbon trading and contributes to effective climate action.

What are the expected outcomes of these efforts?

What are the expected outcomes of these efforts?

|

Standardization, efficiency and harmonization of market infrastructure: |

| Strengthening standardization, efficiency, and unification of digitally enabled market infrastructure for carbon markets by identifying key functions of the market and establishing minimum service standards, common frameworks which are agreed upon by the WG. |

|

Increased access to streamlined solutions for market infrastructure: |

| Facilitating better management of carbon assets to significantly improve the capacity of economies, particularly emerging ones, to engage in carbon markets and mobilize adequate financial resources. |

|

Increased capacity building and technical assistance support: |

| Enhancing technical and institutional capacity at the country level. This encompasses technical assistance and capacity-building for developing host country strategies, policy frameworks, and carbon market infrastructure, including registries, MRV systems, and more. |

|

Enhance investor confidence and mobilize private sector: |

| Strengthening carbon market infrastructure is essential for reinstating investor confidence. A robust infrastructure supported by adequate regulatory, policy, and framework measures is likely to enhance transparency and, in turn, foster trust in global carbon markets. |

What are the key priority areas identified within the CMI WG?

What are the key priority areas identified within the CMI WG?

In the Working Group inaugural meeting, participants identified and prioritized three essential areas for action based on the current bottlenecks —Ecosystem Governance, Information Security & Transaction Integrity, and Interoperability—which will guide the group’s efforts and collaborations moving forward.

Ecosystem Governance (Priority Area I):

Priority area I of the CMI WG centers on mapping and clarifying current ecosystem governance within carbon markets, with an emphasis on identifying key entities and functions within market infrastructure.

Overarching Bottlenecks: Conflicting roles, responsibilities, and functions across the carbon market infrastructure ecosystem.

To address this, the Working Group will establish clear, consistent terminologies and frameworks; identify the roles and responsibilities of entities across value chain stages to ensure accountability, transparency, and effective coordination among all market participants. This effort aims to clearly define and distinguish these elements within the ecosystem.

Information Security & Transaction Integrity (Priority Area II):

Priority area II of the CMI WG consists of strengthening information security and transaction integrity in carbon markets.

Overarching Bottlenecks: Poor documentation and inadequate knowledge of current practices and standards related to Information Technology security and transaction integrity measures, undermines trust in the market.

To address this, the Working Group will develop common guidelines on good practices to strengthen the security of information systems and ensure the integrity of transactions, reducing the risks of fraud and enhancing trust through robust standards such as MFA and KYC/AML/ABC programs.

- Kick-off Presentation on Priority Area II by S&P and Xpansiv [link]

Data and Systems Interoperability, and Digital MRV (Priority Area III):

Priority area III of the CMI WG is based on the recognition that data and systems interoperability in carbon markets is critical to building cohesive and efficient market infrastructure.

Overarching Bottlenecks: Lack of interoperability of data and systems across carbon markets value chain, combined with the absence of a well-defined integrated marketplace architecture.

To address this, the Working Group will develop common guidelines on technical standards, data taxonomies and formats, and best practices to enhance data harmonization and systems integration, enabling seamless information exchange across platforms and improving interoperability, transparency, and scalability within the carbon markets.

These three priority action areas are closely interwoven, targeting systemic bottlenecks within the carbon markets infrastructure ecosystem, including fragmentation, information asymmetry, and unclear accountability. Progress in these areas hinges on effective collaboration and alignment among stakeholders to develop a resilient and robust market infrastructure essential for sustainable carbon markets.

What are the expected outputs of these efforts?

What are the expected outputs of these efforts?

The planned outputs of the Working Group are the following:

1. “A Roadmap for Safe, Efficient and Interoperable Carbon Markets Infrastructure” (to be released at COP29):

The roadmap is the first output of the CMI WG. It lays out the critical bottlenecks and priority areas and recommendations for building safe, efficient, and interoperable carbon market infrastructure identified in discussions. It also features a dynamic, evolving mapping of the carbon markets ecosystem, which will be updated throughout the work on priority area I.

The bottlenecks outlined in this roadmap focus on highlighting priority areas that demand the stakeholder community’s attention within the market infrastructure space. It establishes a foundation for the CMI WG’s future agenda, which consists of developing comprehensive guidance notes that delve deeper into each identified priority area. These detailed guidance notes are scheduled for release in June 2025, when the 62nd sessions of the UNFCCC SBSTA will occur.

2. Five guidance notes dedicated to each identified priority area:

- Technical Guidance Note on Ecosystem Governance for Carbon Markets Infrastructure: Assessment and Recommendations

- Technical Guidance Note on Transaction Integrity for Carbon Markets Infrastructure: Tools and Recommendations

- Technical Guidance Note on Information Security for Carbon Markets Infrastructure: Tools and Recommendations

- Technical Guidance Note on Enhancing Data and Systems Interoperability for Carbon Markets: Current Landscape and Strategic Recommendations

- Technical Guidance Note on Standardizing Digital MRV in Carbon Markets: System Evaluation Criteria and Hotspots Assessment

Currently, the Working Group has drafted the following documents:

- Developed Preliminary Ecosystem Mapping. It can be found here: [link].

- A Roadmap for Safe, Efficient and Interoperable Carbon Markets Infrastructure. It can be found here: [link].

For feedback, please contact climatewarehouse@worldbank.org.

Who are the current participants of the Working Group?

Who are the current participants of the Working Group?

Members of the CMI Working Group

Abaxx Exchange, Air Carbon Exchange, B3—Brazilian Stock Exchange, BeZero Carbon, Climate Action Data Trust (CAD Trust), Climate Impact X, CME Group, Ecoregistry, European Bank for Reconstruction and Development (EBRD), Global Carbon Council (GCC), Global Carbon Market Utility (GCMU), Gold Standard, Indian Energy Exchange (IEX), INFRAS, Integrity Council for the Voluntary Carbon Market (ICVCM), Intercontinental Exchange, International Standards Organization (ISO), International Swaps and Derivatives Association (ISDA), Johannesburg Stock Exchange (JSE), Nasdaq, Philip Lee LLP, Puro.earth, S&P Global, Stock Exchange of Thailand (SET), SustainCERT, Sylvera, US Treasury, Verra, World Bank, and Xpansiv.

The International Organization of Securities Commissions (IOSCO) Secretariat and the Climate Data Steering Committee (CDSC) participated as observers.